The new rules require registered firms and registrants to perform the following:

Conflicts of Interest: Addressing material conflicts of interest in the best interest of the client. This happens when the interests of the client and advisor are not aligned. A conflict can be compensation-related, product-related, on fair allocation, referral arrangements, or lending or borrowing money from a client or purchasing or selling assets directly from a client.

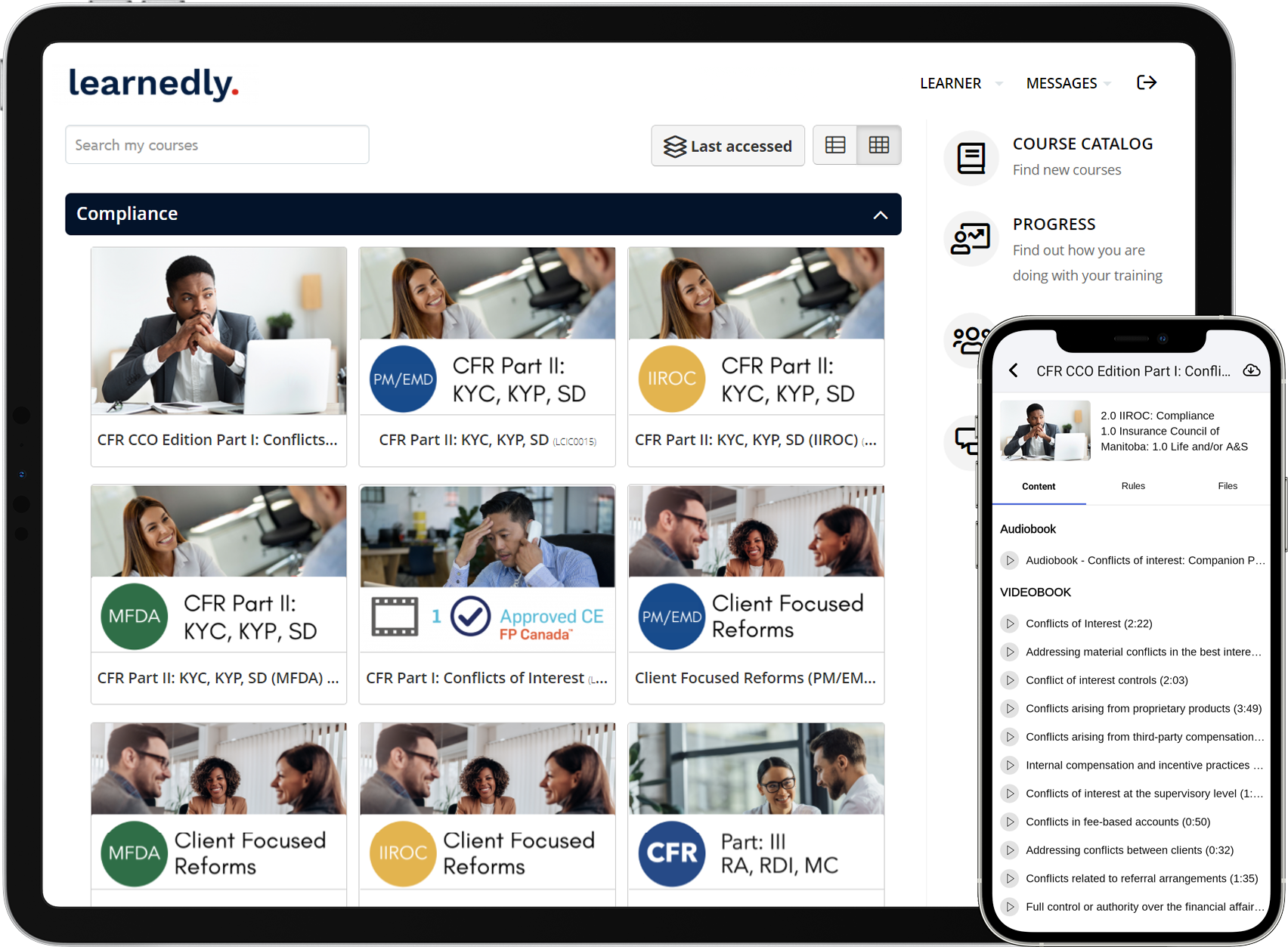

Know Your Client (KYC): Tailoring decisions based on the client’s needs and circumstances and keeping information current. This includes personal circumstances (not limited to financial circumstances), investment knowledge, risk profile, and investment time horizon.

Know Your Product (KYP): Registered firms and registrants must perform product due diligence for all securities offered to clients. This would include performing a comparison between securities made available to clients and other similar securities in the market, prescriptive requirements in terms of securities transferred, maintaining an offering of securities and services that are consistent with the firm.

Suitability Determination: Registered firms and registrants must make recommendations that are in the best interest of the client. This is based on numerous factors, such as Know Your Client (KYC) information, the registrant’s assessment of the security consistent with Know Your Product (KYP) information, the effect that the action has on the client’s account, and the potential and actual impact of costs on the client’s return on investment (ROI).

Relationship Disclosure Information (RDI): Registered firms and registrants must clearly state to clients what they should expect from them. This information includes the type of account the client has, a thorough description of the client’s assets, a general description of the products or services a firm offers, and any limitations on those offerings.

The amendments require registered firms to provide mandatory CFR training for their registered individuals and keep records of all training.